Blog Archive

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- February 2018

- January 2018

- December 2017

- November 2017

Categories

5 sensible steps to take if your fixed-rate mortgage deal ends in 2024

Published: September 4, 2024 by Jennifer Armstrong

While the Bank of England (BoE) has started to cut its base interest rate, many homeowners with fixed-rate mortgages that end this year will still see their outgoings rise. If your mortgage deal comes to an end, read on to discover five sensible steps you might want to take.

According to a report in the Times, around 153,000 mortgage deals will end every month for the rest of 2024. Many of those who fixed their mortgage two or more years ago will have benefited from paying an interest rate that’s less than 2.5%. Even with rates starting to fall many will now face higher mortgage repayments.

The Bank of England’s base rate was cut to 5% in August 2024

In August 2024, the BoE cut the base rate from 5.25% to 5%. If inflation remains stable, it could make further cuts this year. Yet, if you’ve had a fixed-rate mortgage that expires soon, the interest rate you pay could still be higher.

As you typically borrow large sums through a mortgage, even a relatively small increase in the interest rate can add up.

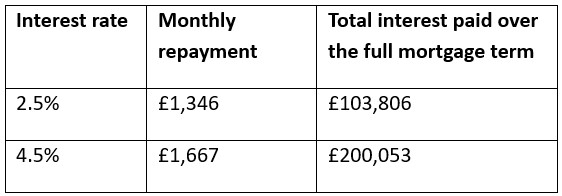

Let’s say you borrow £300,000 through a repayment mortgage with a 25-year term. The table below shows how the interest rate could affect your monthly outgoings and the total interest you’d repay over the full term.

Source: MoneySavingExpert

As you can see, a change of just 2% could have a significant effect on both your short- and long-term finances.

The good news is that when you’re remortgaging, you’ll often be taking out a deal to borrow a lower sum than you did previously, so your repayments might not rise by as much as you expect.

In addition, if the amount of equity you hold in your home has increased, either through making repayments or due to the value of your home rising, you’ll often be able to access a more competitive deal.

You don’t have to take out a new mortgage deal when your existing one ends, but it could save you money.

Usually, when your deal ends, you’ll be moved on to your lender’s standard variable rate (SVR), which is often higher than comparable deals. As a result, searching for a new mortgage could lower your repayments and the amount of interest you pay overall.

So, if you want to take out a new mortgage in 2024, here are some steps that could help you secure a lower interest rate.

5 useful steps that could help you secure a mortgage that’s right for you

1. Don’t automatically apply for a mortgage with your existing lender

You can choose to stay with your existing lender when you take out a new mortgage deal. Doing so could mean you avoid paying fees and speed up the process.

However, you could overlook a deal that’s better for you if you don’t consider other lenders. So, rather than automatically signing the paperwork with your current lender, it could be worthwhile to shop around and compare deals. You might find that a different lender offers you a lower interest rate or has terms that suit your needs.

2. Determine how much you need to borrow

To accurately compare deals, you need to understand how much you want to borrow through a new mortgage.

Your mortgage statement will show the outstanding balance on your current mortgage. In some cases, you might want to borrow more, to fund a home renovation project or cover other expenses, or use other assets, like your savings, to reduce the loan.

As mentioned, lenders consider how much equity you hold when assessing your application. Typically, you’ll be viewed as less of a risk if you hold more equity. As a result, you’ll often be offered more favourable terms as the amount you borrow relative to the property’s value falls.

So, as well as reviewing how much you need to borrow, you might also want to get an up-to-date valuation of your property.

3. Review your credit report

Lenders will use your credit report when assessing your mortgage application. Going through the report could highlight potential issues and give you a chance to rectify them, which might improve your chances of securing a mortgage or a better interest rate.

4. Consider mortgage terms that may be important to you

While the interest rate is important when taking out a new mortgage deal, other factors could be just as essential to you. Considering your plans and financial circumstances over the next few years could help you identify which mortgage deals suit your needs.

For example, if you want to reduce your outgoings now, you might want to take out a mortgage that does not have an arrangement fee. Or if you plan to make regular overpayments on your mortgage, you may want a deal that allows you to do this without paying a penalty.

5. Work with a mortgage broker

A mortgage broker could work with you to understand which lenders are right for you and are most likely to accept your application. Working with a mortgage professional may help you secure a mortgage deal that’s more competitive and guide you throughout the application process.

If your current mortgage deal will end in 2024, please get in touch. We’ll help you understand what your options are and could offer support as you apply for a new mortgage.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.