Blog Archive

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- February 2018

- January 2018

- December 2017

- November 2017

Categories

Cost vs value: What’s the difference when you’re making a financial plan?

Published: December 12, 2023 by Jennifer Armstrong

When you’re making decisions, cost might be an important factor, but value could be just as crucial. Balancing cost and value in your financial plan could help you get more out of your money.

When talking about the investment market, Warren Buffett, known as one of the world’s most successful investors, once said: “Price is what you pay; value is what you get.”

It’s a definition that can be applied outside of investing to other aspects of financial planning too.

How to measure the value of an item or service

The cost of goods or services is usually easy to assess by looking at the price. Determining value could be more difficult. Yet, it may be an important task so you can make decisions that are right for you.

To calculate the value of an item or service you might need to consider quality or performance. In addition, your needs will affect the value too. So, your view of how valuable a particular item is could be different to someone else’s.

Deciding the value of an item is something you probably already do when you’re making large purchases.

If you’re buying a new TV, as well as looking at the price tag, you might assess the type of screen technology it has or whether it boasts smart features. You may also consider the quality of the brand or read reviews from other customers.

The process of balancing cost and value may be similar when you’re making financial decisions.

Let’s say you have a lump sum that you’d like to invest through a fund. How do you determine which option is right for you?

When reviewing an investment fund, the cost, such as the management fees, may factor into your decision. When you’re weighing up value, you might want to consider questions like:

- What are the projected returns?

- How has it performed in the past?

- Does the risk profile suit my needs?

- Could I access the money when I need to?

A fund that has a low management fee might be attractive, but if the risk profile doesn’t align with your investment strategy, it may be of low value to you. Or a higher cost could be worthwhile if the fund may deliver higher returns over your investment time frame.

So, balancing cost and value could help your money go further and ensure your decisions align with your financial plan.

Remember, investment returns cannot be guaranteed, and all investments carry some risk. When you’re deciding if an investment opportunity is right for you, considering your risk profile and investment goals may be useful.

Financial planning could add value by boosting your finances and wellbeing

Value is important when assessing the benefits of financial planning as well, and it’s not just your finances that could receive a boost but your emotional wellbeing too.

The monetary benefits of financial planning could outweigh the cost

Many people seeking a financial planner do so because they want to understand how to grow their wealth and ensure they’re on track to reach long-term goals. The good news is research indicates those working with a financial planner could benefit financially.

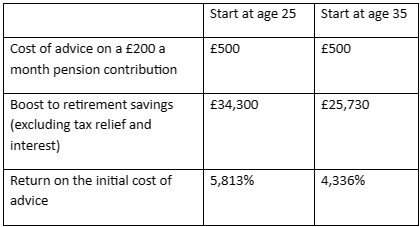

According to an Unbiased report, those who seek advice about their pension at the start of their careers could look forward to a retirement that offers more financial freedom.

The table above shows how the initial cost of seeking advice could be returned many times over when you look at the long-term benefits. So, for some people, the long-term financial value could outweigh the cost.

Financial planning could add value by improving your wellbeing

While the financial benefit of seeking professional advice is important, research suggests the positive effect it can have on your wellbeing could be just as valuable.

In fact, a study published in Professional Adviser asked people with more than £300,000 of investable assets about the benefits of financial planning, and the results might surprise you. More than half of survey respondents said one of the key reasons they use a financial planner is the peace of mind it provides.

There are other non-financial benefits of working with a financial planner too. You might appreciate the time saved by having someone manage your finances on your behalf so you can focus on what’s most important to you. Or a financial planner could help you focus on your long-term goals.

Contact us to talk about your financial plan

Financial planning could add value to your life by helping you get more out of your money and feel confident about your finances. We’ll work with you to create a tailored plan that suits your goals and address any concerns you might have.

If you’d like to arrange a meeting to talk to us about your finances, please get in touch.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation and regulation, which are subject to change in the future.