Blog Archive

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- February 2018

- January 2018

- December 2017

- November 2017

Categories

House prices reach a record high, but will it continue and should first-time buyers wait?

Published: June 2, 2021 by Jennifer Armstrong

Despite the challenges of the last year, house prices have continued to climb. Now at a record high, should first-time buyers wait with the expectation that prices will fall? Read on to find out what’s happening in the property market.

According to the Halifax House Price Index, house prices have increased by a staggering 8.2% in the last year. As of April 2021, the average price for a home is £258,204 after prices increased by £3,600 in the space of just a month. There are many reasons why house prices have risen in the last 12 months, including:

- Pent-up demand: The pandemic meant that last summer the property market ground to a halt. As a result, there has been a surge in demand, leading to prices rising. According to Rightmove, almost one in four properties that had a sale agreed in March had been on the market for less than a week.

- Stamp Duty holiday: In a bid to keep the property market going, the chancellor introduced a Stamp Duty holiday ensuring most homeowners wouldn’t need to pay the tax when moving. This not only encouraged homeowners to move, but means they may have more money to purchase their next home.

- Government-backed mortgages: In March, the government announced it would back 5% mortgages. This aims to make it easier for aspiring homeowners to save a deposit and secure a mortgage. It’s meant homeownership dreams have become closer for first-time buyers.

On the other side of this, there are concerns that house prices will fall later this year. The Stamp Duty holiday will end in June, with a staggered return to previous Stamp Duty rates at the end of September. The furlough scheme, which has been paying an income to workers unable to work during the pandemic, will also end in September.

If you’re a first-time buyer, should you put off getting on the property ladder or start looking for your home now?

2 things to consider if you’re thinking about buying a home now

With house prices rising, you may consider putting off your home buying plans as a first-time buyer. But it doesn’t automatically mean you should. Here are two things to consider if you’re weighing up your options.

1. Demand could increase in the coming months

While rising demand has in part led to house prices rising, it’s not something that’s expected to disappear soon. In fact, as lockdown restrictions ease and economic optimism recovers, it’s expected that demand will increase further, which could push up prices.

Mike Scott, chief analyst at estate agent Yopa, said: “Delays in moving due to the recent situation are obviously going to exist. But the extent of the delay reported by potential first-time buyers suggests that there is still pent-up demand waiting for the restrictions to ease further.

“[We] do not expect an immediate national fall in prices once the Stamp Duty holiday ends. We believe that the lifting of Covid-19 restrictions – combined with people’s reassessed post-pandemic housing needs, the ‘accidental savings’ that many have made over the past year, and the desire for a post-pandemic fresh start – will keep house prices high for at least the rest of this year.”

2. Interest rates are low and there’s more choice for first-time buyers

Interest rates have been low for more than a decade, meaning it’s cheaper than ever to borrow to buy a home. While interest rates are unlikely to rise significantly in a small space of time, before the Covid-19 pandemic, it was expected they’d rise gradually as the economy strengthened.

On top of this, there are now more options for high loan-to-value (LTV) mortgages, including those with a 95% LTV, meaning you need a deposit of just 5%.

The combination of these factors means there are more options for mortgages for first-time buyers and the opportunity to lock in a low-interest mortgage that could save you money.

Finding the “right” time to move

There’s no “right” or “wrong” time to buy a house that applies to every first-time buyer. It’s more important to find the right home for you than whether economic conditions mean you should move. Rather than trying to guess what will happen in the market over the next few months, focus on your personal circumstances. Are you in a financial position to buy? And do you have the deposit needed to secure a mortgage?

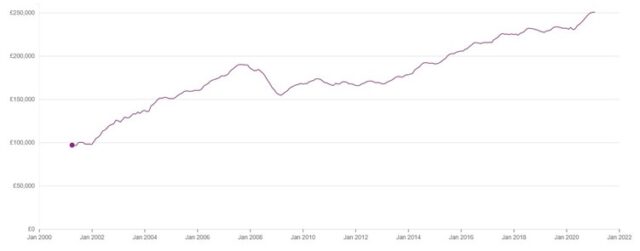

No one wants to pay more than they have to, and for first-time buyers, negative equity, where you owe more than your home is worth, can be a concern. However, keep in mind that, historically, house prices have increased and bounced back from falls. The below graph highlights this.

Source: Land Registry

Between April 2001 and April 2021, the average house price has increased by more than £153,842, despite the impact of the 2008 financial crisis and the pandemic. While house prices could dip in the coming months, over the long term, you’re likely to see the price of your home continue to rise.

If you’re a first-time buyer and would like to discuss if you’re in a position to buy now, please contact us.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.