Blog Archive

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- February 2018

- January 2018

- December 2017

- November 2017

Categories

The State of the Protection Nation

Published: December 18, 2017 by Jennifer Armstrong Last year Royal London commissioned a survey entitled ‘The State of the Protection Nation’ in order to test the perceived need and trust in both the protection industry and the products available and the results were published earlier this year.

Last year Royal London commissioned a survey entitled ‘The State of the Protection Nation’ in order to test the perceived need and trust in both the protection industry and the products available and the results were published earlier this year.

The findings state that consumers have a confidence ranking of 53.2 out of 100 based on awareness, usage and confidence of protection products. Not surprisingly the adviser confidence was higher, but there is a consensus that greater education and new innovations are required in order to see these scores improving.

The perceived need for life insurance varies across different age ranges and it seems to be a case of the older you are the wiser you become as 58% of those aged over 55 believed life insurance is essential if you have a mortgage or dependants but only 37% of 18-34-year olds felt the same way. Late 20’s/ early 30’s is likely to be a time when your protection needs are at their highest as you start a family and either buy your first home or move on to your second home as your family expands.

What is unfortunately consistent across the age groups is that recognising the need for protection doesn’t directly lead to any action to put cover in place. The worst performing group for this is the over 55’s. If you remember 58% said they felt it was necessary but of those surveyed only 30% either held life cover or were in the process of getting it sorted. In a group that has probably seen some financial shocks in their lifetime either through ill health or loss of income and is more aware of their own mortality than the younger generations this is a low figure.

Even more worrying is the general uptake for protection in general. Of those who took part in the survey only 26% have life cover, 6% have critical illness and 4% have income protection. When quizzed the main reasons for not having it in place were the cost, lack of understanding in the benefits it can provide and mistrust over payment of claims.

In terms of cost, the question really is, can you afford not to have it? And how do you know how much it will cost if you don’t take any action to find out?

To address another of the points raised, insurance companies now publish their claims statistics annually and give the reasons for the claims they were unable to pay for reasons such as non-disclosure or not meeting the definition of a particular critical illness.

According to the Association of British Insurers 97.2% of claims are paid (based on 2015 figures). Like anything, it’s always the bad news about non-payment of claims which makes the news. As part of our job we will only ever recommend cover to you which is provided by a company that we trust to do the right thing in the event of a claim.

As mentioned above, a lack of understanding can often be the barrier to getting appropriate cover in place. Confidence in the ability of protection products to provide a solution is a big issue with 29% of 35-54-year olds stating they don’t believe protection insurance is the answer to their individual needs. By contrast only 3% of advisers felt that protection products are failing to provide a real and genuine solution to customers needs so it seems that greater education around the benefits of protection is definitely required. Taking time to identify your needs is time well spent and a financial advisor can help you prioritise these needs and implement suitable solutions.

Almost 2 in 5 (38%) said they felt it was important to ensure their family and dependants are looked after financially should they die, and this figure is fairly constant regardless of gender or age. Whilst this is a low score it seems that 2 ‘life events’ generally influence this belief- having children and previous redundancy.

You would expect people to want to provide for their dependants in the event that they were no longer here to do so and in this regard the figure really should be much higher. It appears that the effect of financial uncertainty as a result of redundancy is also a ‘trigger’ to look at your protection needs as there is recognition that loss of income (due to redundancy, illness or death) could lead to financial hardship for those reliant on that income.

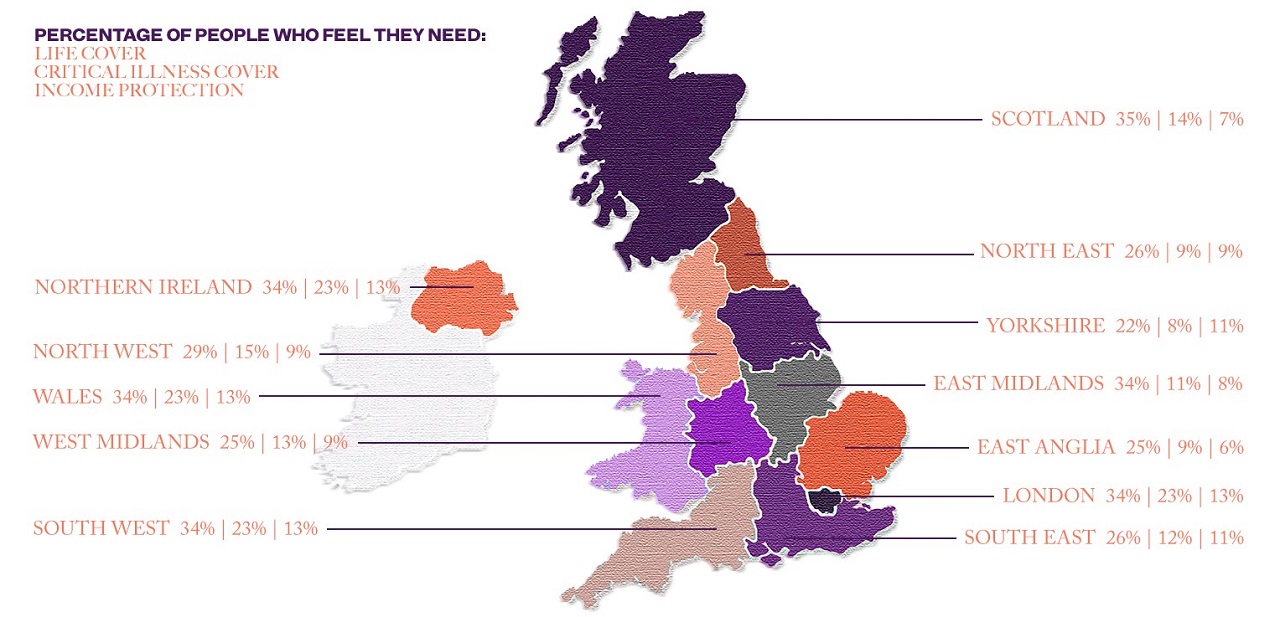

As a region, the views of people in Northern Ireland are fairly standard compared to the rest of the UK but in general terms the gap between the need for protection and the uptake in protection products remains large. Remember, there are a lot of flexible products available which can be tailored to suit individual needs and budgets. Many providers now offer additional services with their protection products over-and-above a payout. In the event of a successful claim, customers of some providers have access to medical and professional advice to help with the emotional consequences of their situation. Others offer this kind of support from the day their plan starts for pre-existing conditions, or conditions they can’t claim for. Part of our job is to compare the products on offer by providers and recommend the ones we feel are most suitable for you based on your individual circumstances.

The next ‘state of the nation’ report should be available in the first half of next year, watch this space….