Blog Archive

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- February 2018

- January 2018

- December 2017

- November 2017

Categories

The number of buy-to-let mortgages available rises, but rates remain high

Published: April 20, 2023 by Jennifer Armstrong

The number of buy-to-let mortgages fell last year, but the figure is now on the rise. However, interest rates remain high, so it’s still vital landlords search for the right deal for them.

The mini-Budget, delivered by former chancellor Kwasi Kwarteng in September 2022, led to lenders pulling some mortgage deals from the market. It meant landlords have had less choice in a high interest rate environment.

According to This is Money, the number of buy-to-let mortgages has rebounded. For landlords searching for a new mortgage, they may find they have more choice.

While this is positive, it could also be overwhelming when trying to figure out which deal is right for you. What’s more, while there are more mortgage deals to choose from, interest rates remain high.

Interest rates for buy-to-let mortgages are 2% higher than they were a year ago

The report suggests the average two-year buy-to-let fixed mortgage had an interest rate of 5.81% at the start of March, regardless of deposit size. This was slightly lower than it was in February.

However, it is significantly higher than the 3.05% it was just two years ago. Five years ago, the average interest rate was even lower at 2.96%.

If you have a fixed-rate mortgage deal, your outgoings could rise much more than you expect when it ends.

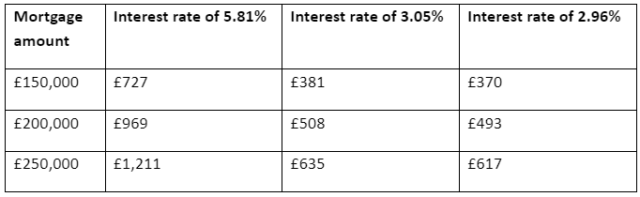

The below table shows how mortgage repayments differ for the average interest rate today, two years ago, and five years ago, based on a 25-year interest-only mortgage.

Source: MoneySavingExpert

As the table shows, your repayments could be hundreds of pounds more due to the interest rate hike.

For landlords, soaring interest rates will affect how profitable properties are. So, it’s essential you understand how and when your repayments could increase to effectively manage your budget.

The increase in repayments may also have a knock-on effect on your long-term plans. For example, if you’d planned to put some of the profits aside to pay off the mortgage debt in the future, you may need to reassess.

While the average interest rate is higher than a few years ago, there are competitive deals. Shopping around could save you thousands of pounds over a mortgage term, so it’s a task that’s worth doing.

Of course, it’s not just the interest rate that’s important. Factors like arrangement fees and the type of mortgage you want should also play a role.

As a mortgage broker, we can search the market on your behalf to find a deal that suits your needs with a lender that is likely to approve your application.

1 in 3 landlords is failing affordability tests

As well as challenges due to rising interest rates, landlords are facing obstacles because of affordability tests.

The This is Money report suggests a third of landlords are struggling to remortgage after failing affordability tests that have become more stringent in the last year. Even if you’ve been paying a mortgage reliably, changes to the way lenders measure risk and how much they’re willing to take could mean they reject your application.

If you can’t access a new mortgage deal, you’re likely to be moved on to a variable interest rate. These often aren’t competitive – you could spend far more servicing the loan than you expect.

Some property investors have been forced to accept a variable interest rate as high as 9.5%. Higher than anticipated interest could lead to your outgoings becoming unsustainable. The survey found that some landlords are choosing to sell properties as they can no longer afford mortgage repayments.

If your mortgage deal is coming to an end, being proactive is important – you can often lock in a deal up to six months in advance. It gives you time to search the market and understand which lenders are right for you, rather than making a snap decision because you don’t want to pay a variable rate.

Get in touch to talk about your buy-to-let mortgage

If you have a buy-to-let mortgage and have questions about what rising interest rates mean for you, please get in touch. We’ll be happy to answer your questions and discuss your mortgage needs.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Buy-to-let (pure) and commercial mortgages are not regulated by the FCA.