Blog Archive

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- February 2018

- January 2018

- December 2017

- November 2017

Categories

3 interesting pieces of data that show why you shouldn’t panic during market volatility

Published: April 11, 2022 by Jennifer Armstrong

Over the last two years, investors have experienced a lot of volatility. If you’ve been tempted to change long-term plans, data can highlight why you shouldn’t panic.

At the start of the Covid-19 pandemic, markets fell sharply, and investors continued to experience volatility as the situation and restrictions changed. Just as things were slowly getting back to “normal”, tensions with Russia began to rise and stock markets reacted strongly when Russia invaded Ukraine in February.

Seeing the value of your investments fall can be nerve-racking, so much so that you may be tempted to make withdrawals or changes to your portfolio.

While there are times when it may be appropriate to change your investments, changes should reflect your personal circumstances. They shouldn’t be a knee-jerk reaction to periods of volatility.

Tuning out the noise and looking at long-term investment trends can be easier said than done. So, these three pieces of data can help you see why, in most cases, sticking to your investment strategy is the best option.

1. Stock market risk falls the longer you invest

All investments carry some level of risk, and the value of your investments can fall.

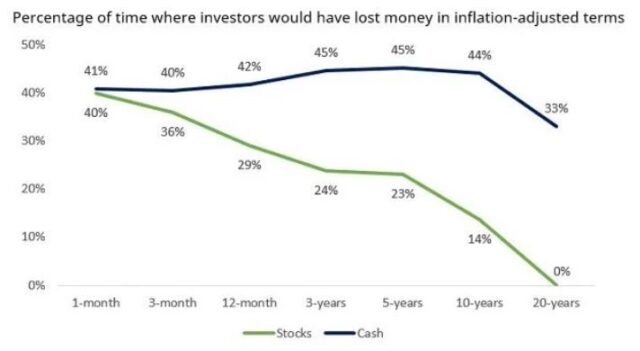

However, over the long term, the ups and downs of investment markets can smooth out. This means that the longer you invest, the less risk there is that you will lose money when you look at the long-term outcomes. This is why you should invest for a minimum of five years. The below graph shows how the risk of losing money overall falls when you invest for a longer period. This compares to holding cash, which can lose value in real terms as the cost of living rises, which interest rates are unlikely to keep up with.

Source: Schroders

So, while you may think about withdrawing your money amid volatility, leaving your money invested could reduce the risk of your portfolio falling in value.

Your investments should reflect your risk profile, which considers several factors, such as your goals and capacity for loss.

2. Markets have historically bounced back

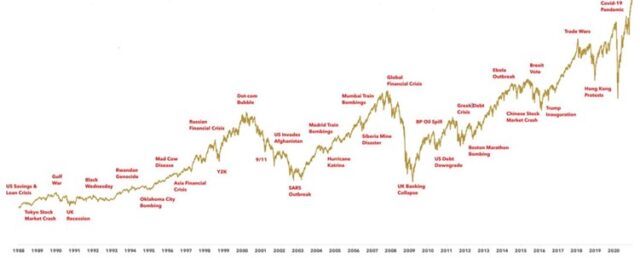

When you’re experiencing volatility, it can seem like a one-off event. Yet, if you look back over the years, you’ll see there are often events that can seem like reasons not to invest or to change your investment strategy.

In the last decade alone, there’s been the Brexit vote, Trump’s inauguration, trade wars, and protests in Hong Kong.

During these periods, your investments may have fallen in value. Yet, if you review the long-term trend, markets have historically bounced back and gone on to deliver returns.

The graph below highlights how negative world events can cause stock markets to fall.

Source: Bloomberg, Humans Under Management. Returns are based on the MSCI World price index from 1988 and do not include dividends. For illustrative purposes only.

While there have been sharp falls, the general trend of stock markets has been upwards over the last 30 years.

Data from Schroders shows that stock market corrections, where there is a 10% drop, are not as rare as you might think either. The US market has fallen by at least 10% in 28 of the last 50 calendar years. Yet even with these dips, the market has returned 11% a year over the last 50 years on average.

3. Trying to time the market could cost you money

As stocks rise and fall, it can be tempting to try and time the market.

Everyone wants to buy stocks at a low price and sell them when the value is high. But it’s incredibly difficult to consistently predict how the markets will change.

Even if you miss out on just a handful of the best performing days of the market, you could lose out. The below table shows the returns from an investment of £1,000 between 1986 and 2021 based on leaving your money invested and missing some of the best days.

Source: Schroders

If you had invested in the FTSE 250, missing just the 30 best days over these 35 years would cost you almost £33,000.

The findings highlight why “it’s time in the market, not timing the market” is a common saying when investing. Staying the course and having faith in your long-term investment strategy makes sense for most investors.

Creating an investment strategy that’s right for you

The above graphs and table highlight why you shouldn’t panic when investment markets experience volatility.

That being said, it’s important to remember that investment performance cannot be guaranteed, and that past performance is not a reliable indicator of future performance.

Building an investment portfolio that reflects your goals and takes an appropriate amount of risk is crucial. If you’d like to talk about investing, whether you have concerns about market volatility or want to start a portfolio, please contact us.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.