Blog Archive

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- February 2018

- January 2018

- December 2017

- November 2017

Categories

The value of a mortgage broker

Published: November 27, 2017 by Jennifer Armstrong

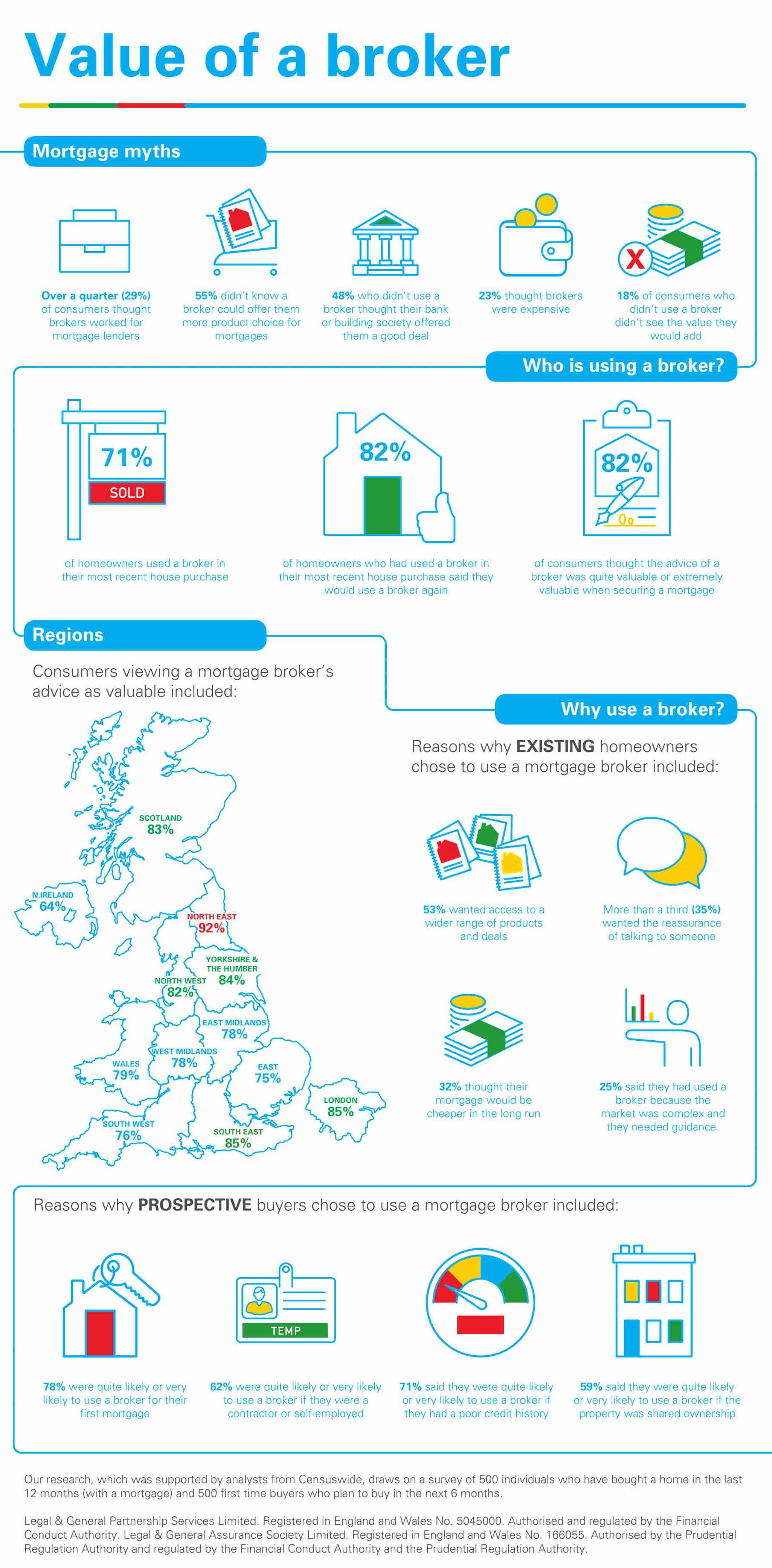

Legal & General Mortgage Club recently released a report entitled ‘The Value of a Mortgage Broker’, They didn’t just write it to point out what a great job we are doing as intermediaries (although that’s lovely to hear) but rather to highlight some common misconceptions about how a broker works and how they can really help guide you through the minefield that is sourcing and securing finance for a new home or rental property.

So, let’s start with some of the myths around mortgage brokers and see if we can get to the truth….

Over a ¼ of those surveyed (29%) thought that brokers worked for mortgage lenders. This is most definitely not the case. The broker works for you, the client. Their aim is to source the most suitable mortgage for your circumstances and based on this independent research place it with their lender of choice with a view to getting the mortgage approved and offered at the most competitive rate possible.

55% didn’t know a broker could offer them more product choice for mortgages. If you have a current account with one of the high street banks your first instinct is probably to speak to them about a mortgage. Remember they can only advise you on what they can offer and are not allowed to comment on products offered by other institutions. In reality there are nearly 30,000 products available to intermediaries and less than 4,000 direct only products.

At Medical & General Financial Solutions Ltd. we have access to the whole of marketplace, so you can rest assured the homework has been done on getting you the most suitable mortgage product.

48% who didn’t use a broker thought their bank or building society offered them a good deal. Think back to your school days…. that % probably would have been a fail. Definitely room for improvement!!

Let’s have a look at some of the other statistics….

As a region, Northern Ireland are the lowest % for engaging the services of a broker – just 64% versus a pretty amazing 92% in the North East, followed closely by London and the South East at 85%. The report goes on to detail the reasons why people use a broker and it all makes perfect sense: consumers want access to a wider range of products and deals, they want the reassurance of talking to someone, and they felt in the long run the cost of the mortgage would be lower. A quarter of those surveyed said they wanted guidance because they felt the market was complex. This is not unfounded; the way the lending criteria, affordability calculations and application process vary between providers can be mind boggling. As experts, it is our job to guide you through with the least amount of hassle.

The survey also focused on prospective buyers and asked their thoughts on the merits of using a broker. Over 75% of first time buyers said they were either likely or very likely to use a broker for their first mortgage, again this goes back to the complexity of the market and the need to speak to a real person for reassurance on a process you’ve never been through before.

Or maybe you’ve sorted your mortgage out yourself in the past and thought never again. If this has led you to be paying the lenders standard variable rate you should really address it as in most circumstances a saving can be made. So, not only can we help with the rate we can also take the hassle out of the process.

Those who felt their situation was ‘more complicated’ e.g. self-employed or poor credit history were more likely to engage a broker, and this reflects the need to get advice to your own specific financial circumstances. The fact of it is, whether your situation is really straightforward or a bit more complex getting professional and tailored personal advice will never do you any harm.

You may have heard chat recently about the increase of ‘robo advice’ but a ‘real life’ broker acting as the agent of their client who understands their specific circumstances and a desire to get them the most competitive and suitable product should trump any robot.

I’m going to end with a couple of really positive points that hopefully reinforce the value of engaging the services of a broker.

82% of homeowners who had used a broker in their most recent house purchase said they would use one again. Surely that is a ringing endorsement of the industry and a reflection of buyers’ respect for brokers’ work and advice. Furthermore, when asked to rate how valuable brokers were in securing a mortgage more than 8 in 10 said a broker was either (27%) or quite (54%) valuable.

Why not have a look at some of our client testimonials, we’re definitely doing our bit to raise those percentages!

Please get in touch if you would like to arrange to come in and speak to one of our advisors about a mortgage. Or if you already have a mortgage it’s still worth making contact; we may be able to improve your terms and save you some money.