Blog Archive

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- February 2018

- January 2018

- December 2017

- November 2017

Categories

Economic conditions could lead to falling house prices and increased negative equity risk

Published: July 4, 2022 by Jennifer Armstrong

Amid challenging conditions, there are concerns that house prices could start to fall. It may affect how much equity you own in your home and could mean some homeowners end up in negative equity.

The effects of the Covid-19 pandemic and the conflict in Ukraine mean inflation is rising in the UK and there’s a risk that the economy could fall into a recession. For many families, this may mean watching their budget more closely and people may delay plans to move or buy a home.

In turn, this can affect house prices as demand slows.

House prices increased by 9.8% in the year to March 2022

Over the last two years, house prices have experienced huge growth as demand outstripped supply. While growth is still high, data suggests that the pace is starting to slow.

According to the Office for National Statistics, house prices increased by 9.8% in March 2022 when compared to a year earlier. The average UK house price reached £278,000 – this is £24,000 higher than it was in March 2021. This compares to house price growth of 11.3% in February 2022.

Speaking to the Telegraph, property expert Paul Cheshire, a former government adviser and emeritus professor of the London School of Economics and Political Science, predicts that property prices will fall by at least 10% in the coming months.

Falling house prices can be seen as a positive for first-time buyers who are struggling to get on the property ladder. However, it can harm existing homeowners, particularly if they have a high loan-to-value (LTV) mortgage.

If you’re worried about falling property prices and the risk of negative equity, here’s what you need to know.

What is “negative equity”?

If house prices fall, there is a risk that some people will be in negative equity.

This means that the value of the property is lower than the amount that you owe on a mortgage. As a result, if you sold your home when you had negative equity, you would need to use funds from other sources to pay off the rest of the mortgage.

The current economic situation could mean that people are more likely to fall into negative equity if they have a high LTV.

The LTV ratio divides how much you’ve borrowed through a mortgage by the value of the property. So, if you’re a first-time buyer and put down a 5% deposit, your LTV would be 95%. As you make repayments or the property’s price rises, the LTV will fall.

Homeowners with a higher LTV are more likely to be affected by falling property prices as they have less existing equity in their homes. As a result, a smaller fall in prices can push them into negative equity.

While falling property prices and negative equity can be worrisome, they often won’t materially affect homeowners.

Historically, the property market has recovered following dips

If you’re worried about property prices falling, looking at how the market has recovered in the past can help.

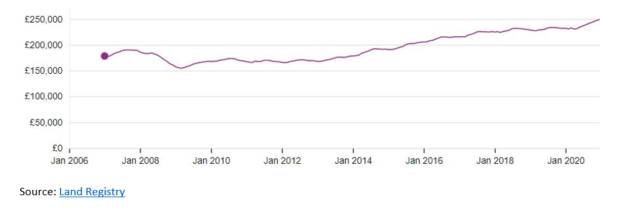

Historically, property prices have recovered and gone on to rise further. For instance, following the 2008 financial crisis, property prices fell by more than 15% at the start of 2009 when compared to a year earlier.

In September 2007, the average price of a home in the UK was a little more than £190,000, then fell by around £35,000 over the next two years. During this fall in house prices, many homeowners were understandably worried, but prices went on to recover and are now at an all-time high.

The graph below shows how the price of an average home in the UK has changed since 2007. While there have been several dips or periods of stagnation, the overall trend is upwards.

It’s important to remember that while on paper the value of your property may have fallen and you’ve lost out, these losses aren’t realised unless you sell your home. So, if you don’t plan to move, falling property prices and even negative equity will have little effect on you in real terms.

If you’re selling your home during a downturn, it could affect your plans.

While you may receive an offer to sell your home for less than you’d hoped, usually the property you want to purchase will also have fallen in price. As a result, in many cases, falling property prices shouldn’t delay your plans, but you may choose to do so.

If you have negative equity, you will need to consider how you’ll pay off your mortgage and whether moving now is still the right choice for you. A delay could mean prices start to rise and your ongoing mortgage repayments will help you to get back into positive equity.

Whether you want to move home or remortgage your current property, we can help you find a mortgage that suits your needs. Please contact us to discuss your property plans with one of our team.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.