Blog Archive

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- February 2018

- January 2018

- December 2017

- November 2017

Categories

How the Labour government could change Stamp Duty in the Autumn Budget

Published: October 7, 2025 by Jennifer ArmstrongOn 26 November, the chancellor, Rachel Reeves, will deliver the government’s Autumn Budget, setting out fiscal plans for the year ahead and beyond. There’s speculation that some of the announcements could affect homeowners, including changes to Stamp Duty.

According to a September 2025 article from the BBC, the National Institute of Economic and Social Research estimates the chancellor will need to plug a £50 billion gap in public finances.

While the chancellor has played down this figure, it has led to expectations that taxes will increase or public spending will be cut. One such tax that headlines suggest could be mentioned in the Budget is Stamp Duty.

Stamp Duty is a tax you pay when you purchase property or land

In England and Northern Ireland, Stamp Duty is a type of tax you pay when you purchase land or property.

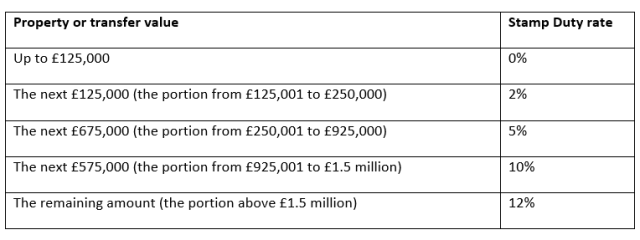

In 2025/26, the Stamp Duty rates are:

Usually, if you own another residential property, you’ll pay an additional 5% on the rate above.

If you’re buying your first home, you may benefit from a relief. This could mean you don’t need to pay Stamp Duty (if you’re buying a property for £300,000 or less) or you pay Stamp Duty at a reduced rate (if the property is worth between £300,001 and £500,000).

There are similar taxes in Wales and Scotland, though the thresholds and rates are different. As these taxes are set by the Welsh and Scottish governments, an announcement in the Budget about Stamp Duty may not affect homebuyers in these areas.

Stamp Duty has been criticised for discouraging moving

Stamp Duty has been criticised as inefficient in the past.

As homemovers face a large, one-off cost, Stamp Duty can be a deterrent for moving, which may lead to people staying in homes longer than they otherwise would. For example, empty nesters might put off downsizing because they don’t want to pay Stamp Duty. Not only does this affect the family that decides not to move, but it can also mean there isn’t as much choice on the property market overall.

It seems that movers expect there to be changes in the Budget and are worried about the uncertainty.

According to research published by the Intermediary in October 2025, 1 in 5 homeowners have said they are putting plans to sell on hold ahead of the November Budget.

3 ways the chancellor could change property taxes in the Budget

It’s important to note that reported changes to property taxes are just speculation at this stage. We won’t know exactly what changes, if any, will be implemented until 26 November.

However, here are three options Rachel Reeves may be weighing up.

1. Increasing Stamp Duty rates

If Reeves is looking to raise taxes, one simple option might be to increase the existing Stamp Duty rates. However, this could have a damaging effect on mobility, and lead to property sales falling, which could cut government tax receipts and make it harder for first-time buyers.

2. Introducing an annual property tax

One proposal suggests scrapping Stamp Duty and replacing it with an annual property tax. This would likely be a tax paid by homeowners in properties valued above a certain threshold, reportedly £500,000, and could potentially replace both Stamp Duty and Council Tax.

While this would be welcome news for some homemovers, it’s likely to disproportionately affect buyers in London and the south-east, where property prices are higher.

3. Creating a “mansion tax”

There’s also talk of a possible “mansion tax” for homes valued at more than £1.5 million. Under this proposal, homeowners would lose private residence relief on their main home and would pay Capital Gains Tax (CGT) on any increase in the property’s value when they dispose of it.

It could result in large bills, as higher-rate taxpayers pay CGT at a rate of 24% in 2025/26.

Contact us to talk about your mortgage

Choosing the right mortgage option for you could cut your costs over the long term. So, if you’re planning to move home in the coming months and need to take out a new mortgage, contact us to find out how we could help.

Please note: This blog is for general information only and does not constitute financial advice, which should be based on your individual circumstances. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.