Blog Archive

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- February 2018

- January 2018

- December 2017

- November 2017

Categories

Interest rates are predicted to fall to 3% next year and could slash mortgage repayments

Published: October 30, 2024 by Jennifer Armstrong

There could be good news on the horizon for mortgage holders. Experts are predicting that the Bank of England (BoE) will gradually reduce the base interest rate over the next 12 months, which could slash your mortgage repayments.

The BoE’s base rate has a direct effect on the cost of borrowing, including through a mortgage.

During the Covid-19 pandemic, the BoE cut the base interest rate to a historic low of 0.1% to support the economy. However, following a period of high inflation, the Bank increased the rate through a series of rises. As of October 2024, the base rate is 5%.

As inflation stabilises, it’s expected that the BoE will reduce the base rate.

Goldman Sachs predicts the base rate will hit 3% in 2025

Investment bank Goldman Sachs predicts the pressure around inflation and wage growth will start to ease in the coming months, which will spark a round of rate cuts from the BoE’s Monetary Policy Committee (MPC).

According to Mortgage Strategy, Goldman Sachs expects the Bank to cut sequentially from November 2024 until the base rate reaches 3% in September 2025.

Other experts and economists are making similar predictions. So, if you’re currently paying a mortgage, your outgoings may reduce in the coming months.

Interest rates falling could save you thousands of pounds

The interest rate falling from 5% to 3% might seem like a small difference. Yet, as you typically borrow large sums through a mortgage, it could save you thousands of pounds.

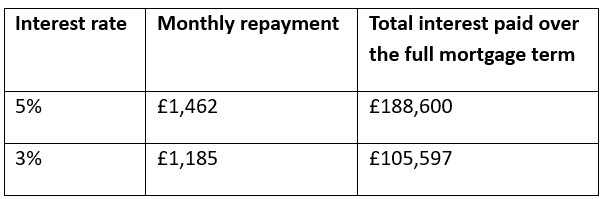

Let’s say you’ve borrowed £250,000 through a repayment mortgage with a 25-year mortgage term. The below table shows how just a 2% change in the interest rate could affect your finances assuming the interest rate you paid stayed the same.

Source: Money Saving Expert

So, the interest rate falling could not only reduce your monthly outgoings, but also add up to thousands of pounds when you consider the interest you pay over the full mortgage term.

You should note that the interest rate you pay may not be the same as the BoE’s base rate. The rate you’re offered by lenders will depend on a range of factors, including your personal circumstances, the loan-to-value ratio of your mortgage, and market conditions at the time you’re taking out a mortgage.

How soon you could benefit from interest rates falling will depend on the type of mortgage you have.

If you have a variable- or tracker-rate mortgage, the interest rate and your repayments may change. So, if interest rates fall, you could benefit in the coming months and your repayments will be lower.

If you have a fixed-rate mortgage deal, the interest rate you pay will remain the same until your current deal expires, at which point you might be able to remortgage to a deal with a lower interest rate.

You may choose to switch to a different mortgage deal to take advantage of lower rates if you have a fixed-rate deal. However, keep in mind that you often have to pay an early repayment fee to do so, which may not make financial sense.

What to consider when choosing a mortgage deal over the next 12 months

With interest rates expected to fall, you might be weighing up your mortgage options if your current deal will end in 2025 – would a variable-, tracker-, or fixed-rate mortgage deal be the right option for you?

There isn’t a simple answer, as it’ll depend on your circumstances and priorities.

Choosing a variable- or fixed-rate mortgage means that your repayments could fall if interest rates are cut. As experts are predicting that rates will fall in 2025, this might seem like a good option. However, keep in mind that circumstances can change, and external factors could influence the BoE’s decision.

If the MPC decided to raise interest rates, your mortgage repayments would also increase.

In contrast, if you choose a fixed-rate mortgage deal, the interest rate you pay will remain the same for a defined period, such as two or five years. So, you wouldn’t benefit if interest rates fell further, but you also wouldn’t need to worry about your repayments unexpectedly rising.

Considering what’s important to you could help you select a mortgage deal that suits your needs – would you prefer to know what your outgoings will be?

Contact us to talk about your mortgage

If you’re looking for a new mortgage or would like to review your current deal, please get in touch. We could help you assess your options and search for a mortgage that meets your needs and potentially saves you money. Please get in touch to arrange a meeting.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.