Blog Archive

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- February 2018

- January 2018

- December 2017

- November 2017

Categories

The chancellor is reportedly drawing up plans to scrap the additional-rate tax band. Here’s what it could mean

Published: March 8, 2022 by Jennifer Armstrong

Reports suggest that the top rate Income Tax band could be scrapped in the next few years. It could cut your tax bill and, somewhat counterintuitively, could increase how much the Treasury takes in tax.

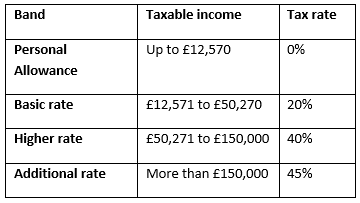

According to a report in Citywire, chancellor Rishi Sunak has drawn up plans to cut taxes ahead of the 2024 election, and Income Tax is one of his main targets. It’s suggested that not only will Sunak cut the basic rate of Income Tax by 2p but he will also scrap the top 45% Income Tax band. For the 2022/23 tax year, Income Tax bands are:

The reported cuts would mean that the basic rate of Income Tax would fall from 20% to 18%. This would save basic-rate taxpayers up to £750 a year.

If you’re an additional-rate taxpayer, the changes could significantly reduce your Income Tax bill. It would mean that earnings above £150,000 would be liable for Income Tax at a rate of 40% rather than 45%.

While your Income Tax bill would go down, scrapping the additional-rate tax band could harm your pension savings. Under the current rules, you can claim tax relief on your pension contributions at your nominal Income Tax rate.

So, if you’re an additional-rate taxpayer, it could mean your pension tax relief falls from 45% to 40%.

Sunak’s plans follow a report from the Office for Budget Responsibility that found the government’s tax hikes in the last two years, including a rise in National Insurance contributions, will mean the tax burden on the public will reach its highest levels since the 1950s.

How would scrapping the additional-rate tax band affect the economy?

With the UK government facing a black hole in its finances following the pandemic, you may think that cutting the highest rate of Income Tax could negatively affect the economy. You may assume it would mean the government would collect less in taxes, yet the opposite could be true.

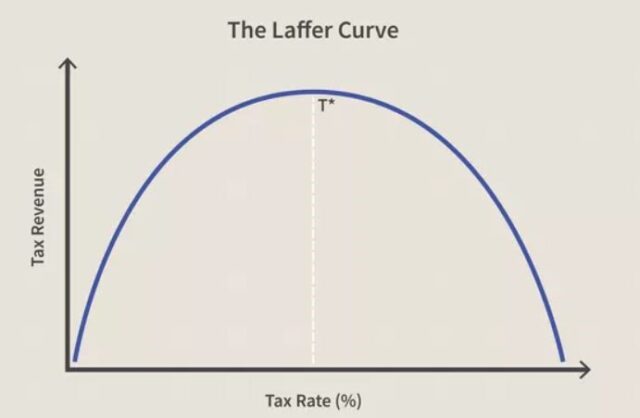

Economist Arthur Laffer developed the Laffer Curve theory, which shows the relationship between tax rates and the amount of tax collected by governments. It’s often used to support arguments that governments should cut tax rates to increase revenue.

The Laffer Curve argues that when taxes are too high, taxable activities, such as working or investing, are discouraged. So, while some people may pay a higher rate of tax, total tax revenue falls.

In contrast, lower tax rates could encourage more people to work and invest to grow their wealth as individually they’ll be liable for less tax. If lower taxes encourage this behaviour in the majority of the population, the government’s revenues increase. The graph below shows how the Laffer Curve theory has an optimal point for collecting the maximum revenue in taxes. After this point, despite taxes rising, tax revenue falls.

Source: Investopedia

So, could cutting the additional-rate Income Tax band increase tax revenue? The Laffer Curve theory suggests the answer could be “yes”, but it can’t be guaranteed.

The Laffer Curve theory isn’t without its critics, and some argue that it’s based on simplistic assumptions. The optimal point for maximising tax revenues also isn’t easy to calculate. It will depend on a huge variety of factors, some of which are likely to change over time.

Incorporating tax changes into your financial plan

While you can’t control what Sunak’s plans are or the outcomes of them, it’s still important to consider changes when reviewing or creating a financial plan.

A change to Income Tax rates and bands could mean you have more income to save, invest, or spend. But, on the other hand, as mentioned above, it could mean paying into your pension is no longer as tax-efficient.

We’re here to help you create a balanced financial plan and to offer advice when changes could affect you. Please contact us to discuss what steps you can take to minimise Income Tax and make the most of your money.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.