Blog Archive

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- February 2018

- January 2018

- December 2017

- November 2017

Categories

What proposed ultra-long mortgages would mean for your repayments

Published: September 1, 2022 by Jennifer ArmstrongAs property prices rise and families face pressure due to the cost of living crisis, the government is reportedly considering ultra-long mortgages.

It’s well-known that house prices have soared in the last couple of decades.

According to the Halifax House Price Index, the average house price is now more than £290,000. Property prices increased by 11.8% in the year to July 2022 alone.

For many first-time buyers, it can make saving a deposit and then securing the mortgage a challenge. A longer mortgage term is a way to reduce repayments to make them more affordable.

However, it’s not just first-time buyers that are struggling.

Rising inflation means the Bank of England has started to raise interest rates, which affects the cost of borrowing. For mortgage holders, it means repayments are likely to have already increased or will in the future.

Many other household costs are rising rapidly too. According to the government, the average household energy bill increased by a record 54% in April 2022. Another substantial rise is expected in October 2022.

So, even households that are already on the property ladder may be looking for ways to reduce their outgoings, such as extending their mortgage term.

The government is considering 50-year mortgages

A report in FT Adviser suggests the government is considering “creative ways” to help first-time buyers afford a home.

Among the proposals are mortgages that could last 50 years.

Traditionally, homeowners have repaid a mortgage over 25 years. However, property prices mean it’s now common to take out longer mortgages and there are already some 40-year mortgages available on the market.

One of the challenges would be paying off a mortgage before you retire or ensuring repayments were affordable when you give up work. This is something lenders test as part of their affordability checks.

The large deposits needed mean that many are in their 30s when they buy their first home. As a result, ultra-long mortgages would mean making repayments into their 80s.

The UK wouldn’t be alone in extending mortgage terms. In some places around the world, ultra-long mortgages are already commonplace. In Japan, for example, it’s not unusual to take out a mortgage that lasts as long as 100 years that parents would pass on to their children.

The government is also considering other options, such as creating a rent-to-own scheme.

How a longer mortgage could reduce your monthly repayments

One of the key benefits of a longer mortgage term is that your repayments will be lower. It could make buying a home more affordable.

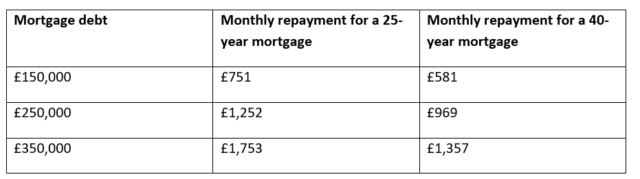

The below table demonstrates how your mortgage repayments would change, assuming an interest rate of 3.5%.

Source: Money Saving Expert

However, only looking at how it affects your repayments doesn’t provide a full picture. You also need to consider the effect it will have on the amount of interest you pay.

When you extend the mortgage term, you’re also increasing how long you’ll be paying interest.

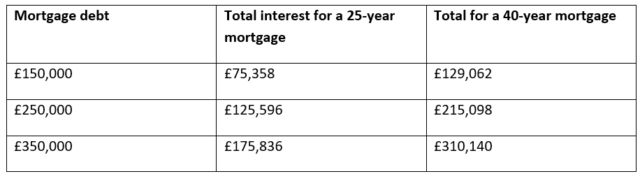

Using the same figures as above, the below table highlights how the amount of interest you pay can add up depending on the mortgage term.

Source: Money Saving Expert

So, while the proposed 50-year mortgage option could mean first-time buyers can get on the property ladder, it could also mean they spend far more on interest overall.

It’s important to keep in mind that as well as extending your mortgage term, you could also shorten it and make overpayments in the future too. For example, you may choose to reduce your mortgage term after a promotion. These options could reduce how much interest you pay.

What mortgage term should you choose?

There are pros and cons to choosing a longer mortgage. When weighing up your options, you need to do so with your budget, circumstances, and goals in mind.

We’re here to help answer your mortgage questions, including how the different options would affect affordability and the cost of borrowing. Please contact us to talk about your mortgage needs.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.